A survey by Marktlink shows that 40% of European SME owners don’t know how much their business is worth. This is a risk factor for entrepreneurs who want to grow: potential investors set great store by a detailed valuation. When plans for a sustainable future are rolled out, a sound valuation is again indispensable. Furthermore, a favourable valuation seems to have a positive effect on the way a business is run: SMEs are more optimistic about their opportunities in the market and therefore less inclined to sell the company at an inferior price. A company valuation helps achieve an optimal sales price.

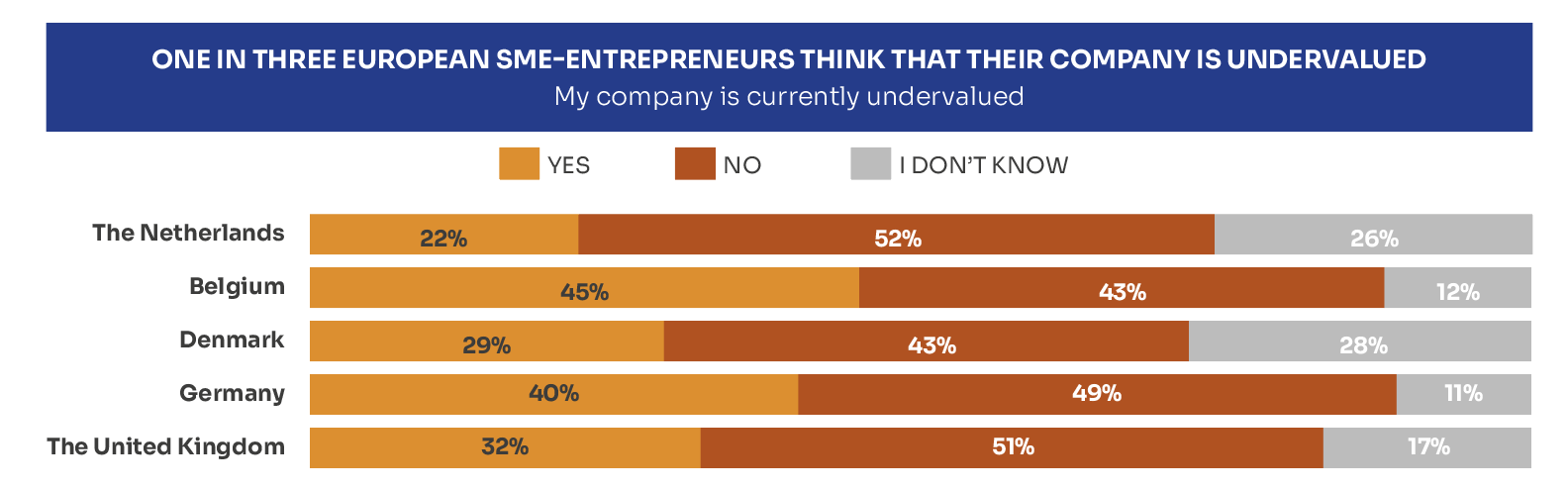

The survey, covering more than 1000 SMEs across Europe, suggests that the majority are optimistic about the value of their business. As many as 72% of respondents expect the value of their company to increase. There are, however, considerable differences between the various countries.

In the Netherlands, the market is changing from a seller’s to a buyer’s market and there is solid demand for SMEs that are up for sale. In Belgium, the focus is mostly on international dealings and not so much on Europe. In Germany, a mismatch has arisen between the demand for SMEs and its supply. Andreas Bonnard, Marktlink’s managing partner in Munich explains: “The share market and valuations of German companies have reached a record high but profit margins are falling. Both the automotive and chemical industries are going through a difficult period, even though Europe more generally is experiencing something of an economic recovery. Unlike the rest of Europe, energy costs in Germany are higher than ever so manufacturers are relocating their factories, putting even more pressure on local business owners.” But to the north of Germany, in Denmark, the economic climate is actually very good for SMEs. According to “Doing Business”, a report published by the World Bank, there’s considerable interest from domestic and foreign buyers in Scandinavian companies. Denmark was explicitly cited as a country with a favourable climate for entrepreneurs.

Although there are differences across Europe, there are also similarities in the challenges faced by SMEs. Specifically, skilled workers are in short supply, automation and robotisation constitute a threat and the integration of sustainability goals is something many SMEs find difficult. Despite these uncertainties, the majority of European SMEs feel confident about their economic opportunities.

But optimism that isn’t supported by figures on how much a business is worth can also be a risk as it might overstate the company’s value and opportunities. This is why it’s advisable for all SMEs to have a valuation done. It will help them verify whether their optimism about opportunities and ambitions is well-founded. Tom Beltman, managing partner of Marktlink in the Netherlands, adds: “Entrepreneurs are often inward-looking and don’t see the market around them. This can lead to misunderstanding because there’s often a difference between emotional value and the actual price a company will fetch when the owner is ready to sell. Unfortunately, you’re not always compensated for the energy you put into your business. There’s a good reason why entrepreneurs become more realistic about the value of their company as they get closer to an exit.”

The Marktlink Multiple provides you with a reliable estimate of the value of your business within one minute, fully without obligation.

Contact us now for more information.